Study on the battery supply chain shows China’s global dominance – and options for Europe

Producing batteries for electric cars requires a complex and globally networked supply chain.

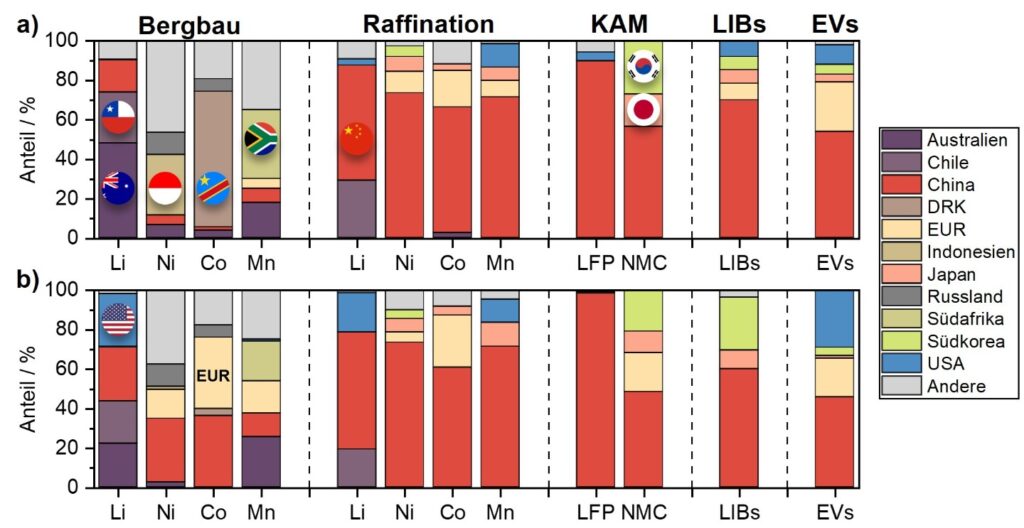

In a recent study, researchers from Fraunhofer FFB and the University of Münster analyzed the ownership structures and geopolitical dependencies along this supply chain. The result: China controls almost the entire value chain of lithium-ion batteries – from the extraction of raw materials to the production of the batteries. The People’s Republic not only controls domestic production facilities but also those abroad – for all raw materials and downstream processes. No other region globally has comparable control along the entire battery supply chain.

Münster. Lithium, cobalt, nickel and manganese are irreplaceable for the production of battery cells. Large battery packs, such as those installed in a “Tesla Model S Plaid”, contain around 122 kilograms of so-called mineral raw materials. Geographically, only a few countries have the resources that are needed in large quantities for the expansion of electromobility. These include China, Australia, and the Democratic Republic of the Congo. The challenge: “Mineral raw materials are at the very beginning of the supply chain for battery cell production, and Europe is almost 100 percent dependent on imports,” says Professor Simon Lux, Director of Fraunhofer FFB.

China’s global dominance in the battery supply chain

The study by the Münster researchers outlines the ownership structure behind mines, refineries and production facilities along the entire battery supply chain. The results show China’s supremacy: the country dominates almost the entire value chain of lithium-ion batteries – from raw material extraction to battery production – and controls both national and international production capacities. The only exception is manganese. The fact that China produces the majority of lithium iron phosphate active materials, with a share of more than 98 percent, means that Europe is directly dependent on this more cost-effective battery chemistry.

“China’s growing dominance of raw materials is jeopardizing the future of European electromobility,” warns Lux. “This dependency makes Europe vulnerable. Geopolitical tensions or export stops could lead to massive economic damage and losses running into billions,” warns Lux.

Securing raw materials in Europe and the USA: between catching up and dependency

Similar to China, Europe, and the USA are also intensifying their efforts to gain greater control over the lithium-ion battery supply chain by acquiring mines and refineries. While the USA is in second place worldwide in terms of ownership shares in lithium mining and Europe’s shares are comparatively small, the picture is the opposite for nickel and cobalt. Australia, Indonesia, and the Democratic Republic of Congo – key regions for the mining of lithium, nickel, and cobalt – are particularly affected by company takeovers. For example, 74% of the world’s lithium comes from Australia and Chile, but Chinese (29%) and US companies (26%) hold the largest shares of production. Europe, meanwhile, has no significant lithium shares abroad. “These developments underline the global competition for critical raw materials and the strategic realignment of value chains,” says Lux.

Options for reducing dependence on China

Export restrictions in the event of geopolitical disputes would have far-reaching consequences for the stability of the global battery supply chain. According to the authors, possible levers for a secure and sovereign battery supply chain in Europe could be investments in the expansion of own refinery capacities, the promotion of strategic raw material partnerships, and the strengthening of the local circular economy. The joint paper by researchers from Fraunhofer FFB and the University of Münster is based on a comprehensive data analysis. To this end, the ownership structures along the global lithium-ion battery supply chain were analyzed and compared with the geographical distribution of production shares. The study aims to draw a holistic picture of the current power structures in the industry.